Elliott Investment Management Sends Letter to the Board of Western Digital Corporation

-

Author

Jasleen Kour

-

Date

Nov 3, 2022

-

Time

2 min read

-

Read by

7.4k People

Calls for Full Strategic Review, Separation of Flash Business

Sees $100+ per Share by 2023, ~100% Potential Upside

Offers $1+ Billion of Incremental Equity Capital to Facilitate Separation

Full Letter Available at ElliottLetters.com/WesternDigital

Elliott Investment Management L.P. ("Elliott"), which manages funds that have an approximately $1 billion investment in Western Digital Corporation (NASDAQ: WDC) (the "Company" or "Western Digital"), today sent a letter to the Board of Directors of Western Digital. The letter called on the Board to conduct a full strategic review of the value that could be created by separating its two vastly different businesses, hard disk drives ("HDD") and NAND flash memory ("Flash").

According to the letter, Western Digital has underperformed—operationally, financially and strategically—as a direct result of the challenges of operating both the HDD and Flash businesses as part of the same company. In its letter, Elliott argued that a full separation of the Flash business would allow both HDD and Flash to be more successful while also unlocking significant value. By executing on a separation, Elliott believes Western Digital's stock price could reach $100+ per share by the end of 2023, representing uniquely attractive upside of approximately 100%.

In addition to its public investment in Western Digital, Elliott is also offering $1+ billion of incremental equity capital into the Flash business at an enterprise value of $17 to $20 billion (a valuation close to the Company's entire current enterprise value), to be utilized either in a spin-off transaction or as equity financing in a sale or merger with a strategic partner. This investment proposal underscores Elliott's conviction on the merits of a separation.

The letter can be downloaded at ElliottLetters.com/WesternDigital.

The full text of the letter follows:

May 3, 2022

Western Digital Corporation

5601 Great Oaks Parkway

San Jose, CA 95119

Dear Members of the Board:

We are writing to you on behalf of Elliott Associates, L.P. and Elliott International, L.P. (together, "Elliott" or "we"), which have an investment of approximately $1 billion and representing over 6% of Western Digital Corporation (the "Company" or "Western Digital"), making us one of the Company's largest investors.

Western Digital serves a critical role in providing fundamental technology to support the ongoing growth of data in two market-leading franchises—hard disk drives ("HDD") and NAND flash memory ("Flash"). In the HDD market, Western Digital has a strong competitive position as the #2 player in an industry that today represents a compelling opportunity, as the demand for near-line HDDs has come to outweigh the steady decline in client PC HDDs. In the Flash market, Western Digital's successful partnership with Kioxia provides technology leadership and important scale benefits as Flash continues its long-term, secular growth.

It has been nearly six years since these two businesses came together through the $19 billion acquisition of SanDisk in 2016. The acquisition was nothing less than transformative. With a single transaction, Western Digital diversified its nearly five-decade business away from HDD and became one of the largest Flash players in the industry. The stated rationale for the deal was the expected synergistic effects of combining a broad portfolio of technologies, improved strategic positioning with customers and an enhanced financial profile.

Unfortunately for the Company and its shareholders, none of these benefits have been realized. By any objective measure, Western Digital has underperformed—operationally, financially and strategically—as a direct result of the challenges of operating two vastly different businesses as part of the same company. This underperformance is particularly disappointing given the Company's great potential in both businesses.

It is important to emphasize that Western Digital's underperformance long predates CEO David Goeckeler and his leadership team, nearly all of whom were hired in 2020 or later. David and his team have steered the Company through a challenging operating environment, and to their credit, they made the important decision in September 2020 to separate the operations of HDD and Flash into separate business units. While this separation was a positive step, the hope that it would lead to better execution has not materialized, and Western Digital's current valuation makes clear that the investment community has not been persuaded that this necessary-but-insufficient step has solved the problem.

We believe a full separation of the Flash business can allow both HDD and Flash to be more successful and unlock significant value. By executing on a separation, we believe Western Digital's stock price could reach $100+ per share by the end of 2023, representing uniquely attractive upside of approximately 100%.

In addition to our public investment in Western Digital, Elliott is also offering $1+ billion of incremental equity capital into the Flash business at an enterprise value of $17 to $20 billion (a valuation close to the Company's entire current enterprise value), which can be utilized either in a spin-off transaction or as equity financing in a sale or merger with a strategic partner. This investment proposal underscores our conviction on the merits of a separation as well as our belief in the long-term prospects of the Flash business.

Today, we are calling on the Board to conduct a full strategic review of these ideas, confident in our view that a comprehensive, independent exploration of the value potential will point decisively toward a separation of HDD and Flash. Though the majority of this Board and management team were not involved in the SanDisk decision, it is nevertheless this Board's responsibility to address current market realities and set the Company on the right course. We are making our perspectives on these matters public, as we want to be transparent and provide all constituents with the opportunity to weigh in for the Board's consideration. At the same time, our goal is to align with you and work closely with the Company to determine the best path forward. To that end, we would welcome a meeting at your convenience to discuss the vision outlined in this letter.

Our letter today is organized as follows:

- Our Investment in Western Digital

- How We Got Here

- Western Digital's Strategic Scorecard

- Path to $100+ per Share

- Working Together

Our Investment in Western Digital

Founded in 1977, Elliott is an investment firm that today manages approximately $51.5 billion of capital for both institutional and individual investors. We are a multi-strategy firm, and investing in the technology sector is one of our most active and successful efforts. Within our technology practice, our team has extensive experience investing in enterprise technology, including prior successful investments across the storage and computing industry. Our experience over the last 15 years includes working with many of the largest companies in this market, including Dell Technologies, EMC and NetApp. We have also been highly active in other relevant areas, including storage software (Commvault, Symantec/Veritas) and data-center infrastructure (Switch, Ark Data Centres).1 Our investing background provided us with broad perspective and insight as we considered how Western Digital must navigate a dynamic market environment.

Elliott's approach to its investments is distinguished by its intensive due diligence, and our efforts on Western Digital have followed this same approach. We enlisted former executives, industry experts, lawyers, accountants and consultants in an exhaustive research process on the Company's strategic position and growth opportunity, as well as considerations for a Flash separation. We believe that this time- and resource-intensive diligence effort has given us a thorough understanding of Western Digital's history and prospects. Our considerable technology-investing experience and comprehensive diligence have informed our perspective that Western Digital is deeply undervalued and that a separation of HDD and Flash is the right path forward.

How We Got Here

With nearly $20 billion of revenue, Western Digital is one of the largest providers of storage components for data infrastructure globally. This end-market is made especially attractive by a confluence of major technology trends that are driving exponential growth in the amount of data requiring storage. Western Digital, along with a small number of competitors, serves a mission-critical role in the development and manufacturing of these products for large enterprises, hyperscale data centers, OEMs and individual consumers.

Over the course of five decades and multiple technological evolutions—including the transition from tape drives to HDDs and the evolving use-cases of HDDs and NAND flash memory—Western Digital has built a highly successful HDD business and earned its industry-leading role alongside Seagate Technology. But with the advent of NAND flash memory, the HDD industry began a slow decline in 2013 as desktop and notebook PCs transitioned toward NAND flash solid-state drives (SSDs), drawn by the latter's superior speed performance. By 2015, the HDD industry was in decline. Many industry analysts predicted the eventual death of HDDs and that Flash would become the prevailing storage medium in the computing industry.

Against this backdrop, Western Digital announced its acquisition of SanDisk for $19 billion in 2015 to diversify its business away from HDDs and to enter the higher-growth Flash industry. This monumental decision represented an "all-in" bet on the synergy benefits of a combined HDD/Flash portfolio—Western Digital was acquiring a $19 billion equity value company when its own market cap was only $20 billion.

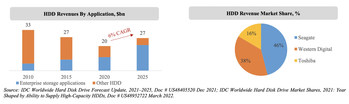

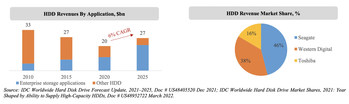

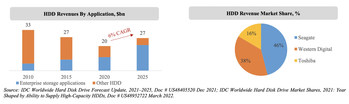

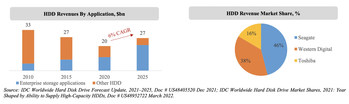

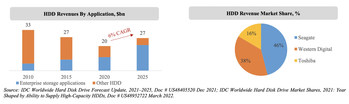

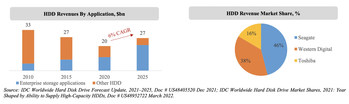

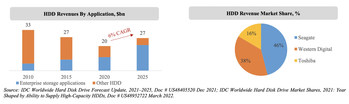

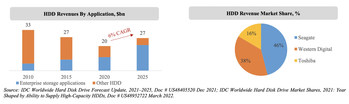

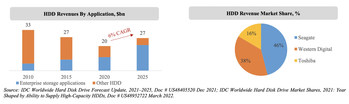

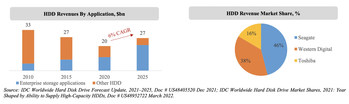

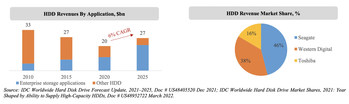

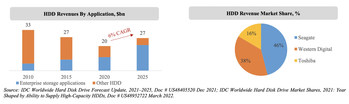

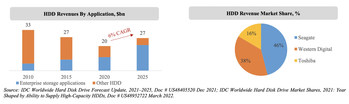

In the six years following the SanDisk acquisition, the HDD industry rebounded and went through a critical change: Demand for high-capacity HDDs ("near-line") from hyperscale data centers and enterprise customers accelerated. As client PC HDDs continued to decline, near-line became the dominant HDD category, and today comprises more than half of the industry. This dramatic change has led the HDD industry to become a growth market once again, and Western Digital is one of the two dominant providers of this technology.

See "HDD Revenues By Application, $bn and HDD Revenue Market Share, %" image.

In the Flash industry, demand for SSDs has been robust, as desktop/notebook PC penetration is approaching 75%, smartphones have become ubiquitous and enterprise SSDs are the standard in use-cases where high speed is required. In the last five years, NAND flash has transitioned from 2D NAND to 3D NAND, and the capital requirements for NAND semiconductor fabs have increased substantially. Western Digital, through SanDisk's two-decade JV relationship with Kioxia (formerly Toshiba Memory), enjoys essential scale benefits as one of the largest combined investors in NAND technology, resulting in the lowest cost per bit in the industry. While NAND pricing can be volatile, the industry has grown by more than 2x, from $32 billion in 2015 to more than $68 billion in 2021.

See "NAND Revenues By Application, $bn and NAND Revenue Market Share, %" image.

When Western Digital acquired SanDisk, the articulated rationale was the synergy benefit of a combined portfolio through technology sharing, manufacturing best practices, distribution leverage and customer intimacy. What is truly remarkable is that Western Digital stands alone as the only company today that operates in both HDD and NAND flash, at a time when the rest of the industry has made the opposite bet. Seagate is #1 in HDD and has remained a pure-play with no captive NAND manufacturing business. Toshiba sold its NAND business to an investor group in 2017 (now known as Kioxia) and today is the #3 player in HDD. Samsung is #1 in NAND and exited its HDD business to Seagate in 2011. Micron and SK Hynix, both active acquirers, have declined to enter the HDD business and have instead focused on complementary DRAM and NAND technologies.

See "Competitive Landscape In Memory Sectors" image.

Western Digital's Strategic Scorecard

Our diligence affirmed that Western Digital operates in attractive end-markets with admirable competitive positions in both HDD and Flash. However, with the benefit of nearly six years of performance since the acquisition of SanDisk, we can assess Western Digital's track record operating as a combined HDD/Flash business. We can see whether the strategic objectives of this transformational decision were achieved. And we can determine whether the Company and its shareholders have been rewarded along the way.

Unfortunately, the conclusion from this evaluation is clear: Western Digital has underperformed its strategic aspirations, and investors' profound lack of confidence in the Company is evident in the extraordinary discount at which they value its stock. In the following section, we briefly review our assessment:

Strategic Initiatives

Over the last six years, Western Digital has attempted to deliver on the strategic synergies of a combined HDD and Flash portfolio. As we have highlighted earlier in this letter, we believe Western Digital is well positioned in each of its markets. Critically, however, we believe that ownership of HDD and Flash together has not created tangible strategic benefits, but rather significant detriment. The evidence over the last six years of Western Digital's performance demonstrates that attempting to manage highly complex, vertically integrated businesses such as HDD and Flash together has resulted in execution missteps and conflicting go-to-market approaches.

To start, we can look at the evolving market share during this period: Western Digital has consistently lost share in HDD, while Seagate, its pure-play competitor, has gained share. In Flash, Western Digital has also lost share, as its bet on leveraging the HDD combination has failed to yield any benefit. In contrast, Seagate is #1 in HDD without a NAND business, and Samsung is #1 in NAND after having sold its HDD business to Seagate a decade ago.

In order to understand why this combination has not succeeded, we can review several of the most heavily emphasized areas of strategic benefit that Western Digital has articulated to defend its strategy. The first is the concept of "customer intimacy," which suggests that Western Digital can foster deeper customer relationships if its product portfolio is larger and it can sell both HDDs and Flash SSDs to the same customer. This concept had the potential to be most relevant and strategic for high-growth data-center use-cases, in which customers buy both near-line HDDs and enterprise SSDs. Western Digital has even argued that its "competitive position within the data center is unrivaled, built on the breadth of our product portfolio" and that the "ability to offer both hard drive and flash-based solutions differentiates us from our competitors."

Over the course of our diligence—and based on our customer interviews and review of the actual results—we have concluded that the customer-intimacy argument is dramatically overstated. Since completing the SanDisk deal, Western Digital has failed to gain market share in either near-line HDDs or enterprise SSDs, nor is it #1 in either business, despite its status as the only company with an integrated portfolio. And finally, Western Digital has publicly and frequently conceded that its enterprise SSD efforts have disappointed for years, despite having previously claimed that this area represented the most exciting growth opportunity from the SanDisk acquisition. At the "Benefits of Developing Flash and Hard Drive Technology" event last year, Western Digital admitted "a very difficult period with respect to our enterprise SSD products."

See "Capacity Optimized HDD Revenue Market Share, % and Enterprise SSD Revenue Market Share, %" image.

The second area of strategic benefit that Western Digital has frequently highlighted has been its ability to "move up the stack" and offer customers integrated solutions rather than underlying storage components. Western Digital has referred to this category as "data center solutions" and has promised significant growth and opportunity in an area where it claimed to have a "unique advantage." This opportunity was featured as one of the five pillars of its transformation at the 2016 Investor Day and was emphasized again when discussing the "cloud opportunity" for these products at the 2018 Investor Day. After years of investment and poor traction, Western Digital finally announced its exit from this initiative in 2019 and sold its main product, ActiveScale, to Quantum Corporation in 2020 for only $2 million.

Execution & Financial Results

In 2020, CEO David Goeckeler announced that Western Digital would form separate business units for HDD and Flash. This was the right decision and underscored the challenge of managing this diverse portfolio of assets. HDD and Flash are entirely different technologies: spinning mechanical disks versus leading-edge semiconductor devices. The manufacturing processes are separate and conducted in dedicated facilities. While the businesses share common customers, the products can be in competition in certain use-cases. It is unfortunate that this decision occurred only after years of execution issues as an integrated business. Goeckeler explained this reality when he stated, "There are technical dynamics between flash and HDD that are very different" and that an operational separation would "lead to better execution." However, even the operational separation has not yielded tangible improvement. As Stifel noted in a report published just last week, "[W]e believe WD has to improve its execution in both businesses in order to capitalize on market opportunities. Some are within its control, some are not, but over the past year, execution has been shaky at best."

The operational missteps over the last six years have consistently led to unfulfilled financial targets. An important rationale of the SanDisk acquisition was that a larger enterprise with greater scale, vertical integration, G&A consolidation, go-to-market overlap and R&D efficiency would generate significant financial synergies. These benefits were laid out in an attractive array of long-term financial targets—a profile that Western Digital claimed would not be possible as a standalone HDD business. At the 2016 Investor Day and again at the Investor Day in 2018, Western Digital outlined these long-term targets to the investment community. As Western Digital's shareholders know well, none of these targets were achieved.

See "Western Digital Performance Against Investor Day Targets" image.

These missed targets are especially disappointing because Western Digital has claimed that ownership of both HDD and Flash provides greater "understanding" and "predictability." At the same investor event titled, "Benefits of Developing Flash and Hard Drive Technology," a long-time executive claimed, "We can see storm clouds gathering or winds gathering behind our back well ahead of anyone else." Regrettably, the Company's track record would suggest otherwise.

Enterprise Value & Valuation Multiples

Today, Western Digital has an enterprise value of $21 billion with revenue of $19 billion—a 1.1x multiple. This valuation compares to the combined $34 billion pro forma enterprise value of Western Digital and SanDisk when they announced the acquisition six years ago, representing $13 billion of value loss. By contrast, in the same period, Seagate grew its enterprise value from $17 billion to $22 billion, with revenue of $12 billion—a 1.8x multiple. Despite having 60% more revenue than Seagate, including $10 billion of Flash revenue, Western Digital's enterprise value is now well below Seagate's.

See "Western Digital EV Evolution, $bn and Seagate EV Evolution, $bn" image.

Given that Western Digital and Seagate operate highly comparable HDD businesses with similar financial profiles (discussed more fully in the following section), comparing valuation multiples over time between these companies is instructive. In the chart below, we illustrate their respective P/E multiples over the last decade, highlighting the stark change in the relationship in 2015. The takeaway is unambiguous: Western Digital traded at a premium P/E multiple prior to the SanDisk deal and has since traded at a substantial discount. Interestingly, the discount has not narrowed despite Western Digital having had many years to improve its operational performance and to demonstrate the merit of its strategy. Hiring a new leadership team has also failed to tighten the discount.

See "Forward P/E Over Time and Western Digital vs. Seagate P/E Multiple Premium/Discount" image.

Stock-Price Performance

When Western Digital announced its acquisition of SanDisk, its stock was trading at $75 per share. Six years later, the stock has declined by nearly 30% to $53 per share. In the same time period, the S&P 500 and NASDAQ increased by 103% and 190%, respectively. More importantly, we can look to Western Digital's direct peers in Seagate for HDD and Micron in NAND/DRAM for relative performance. As noted above, Seagate has remained a pure-play HDD player and has outperformed Western Digital by a spectacular magnitude: 229% since the SanDisk acquisition announcement and 278% over the last decade. Micron, led by the former CEO of SanDisk, has also outperformed Western Digital substantially.

See "Relative Shareholder Returns (USD)" image.

In addition, it is important to highlight that Western Digital's stock-price performance has not improved with a new leadership team. CEO David Goeckeler and his team have performed well despite the challenges of COVID, and we commend the long-overdue decision to separate the HDD and Flash business units operationally and to hire new general managers of each. The fact that the Company's stock-price performance has not improved despite this operational change reflects, in our view, continued skepticism regarding the Company's ability to execute on its strategy with this combined portfolio.

Strategic Scorecard Summary

In our diligence process on Western Digital, we evaluated whether its SanDisk acquisition succeeded and whether HDD and Flash should remain together. The evidence overwhelmingly suggests that the combination has not succeeded and that the business should separate. Western Digital did not realize the touted benefits of acquiring SanDisk, and its valuation and shareholder returns have suffered as a result. Indeed, Western Digital's valuation today reflects the market's view that owning HDD and Flash together yields a dis-synergy in terms of operational and financial performance.

When a strategy has so clearly failed to meet its objectives, we believe it is time to consider other alternatives. In the following section, we outline our perspectives on a better path forward that we believe Western Digital's Board should pursue.

Path to $100+ per Share

Today, we are recommending a strategic review at Western Digital. We believe that the Board should immediately commence an evaluation of the benefits of separating the Flash business, which may include a wide range of potential transactions.

Western Digital is in the enviable position of owning two industry-leading businesses in attractive markets with significant scale and profitability. Both the HDD and Flash businesses can stand alone as successful industry leaders, and both demonstrated superior performance prior to Western Digital and SanDisk coming together in 2016. We have high conviction that this is the best path forward for each business' long-term success and position in the industry. For shareholders, we believe this course of action can deliver exceptional results, with the potential for value of $100+ per share by the end of 2023.

Of course, what we are suggesting is not novel. We are confident that many shareholders agree with our view and have likely communicated the same proposal directly to management and the Board. The equity research community also frequently highlights the value upside from a separation, and many analysts use a sum-of-the-parts analysis to value Western Digital. The excerpted quotes below are a sampling of this commentary:

- "The board of directors, senior management and shareholders should be aware of the potential value unlocking via the sum of the parts, splitting up the company, and perhaps the most likely course of action of simply getting its internal operations to post consistent solid results." – Citi, March 2022

- "[W]e would also highlight continued SOTP valuation support from a Kioxia IPO later this year…as well as a potential bidding war for Toshiba (suggesting PE buyers see value in NAND/HDD). With all of these factors in mind, we continue to see WDC as a TOP PICK with fair value of at least $100" – Evercore, May 2021

Valuation of HDD

Over the last two decades, the HDD industry has consolidated to three companies: Seagate, Western Digital and Toshiba. Today, Seagate and Western Digital dominate the industry, with a combined market share of more than 80%. While each company has its strengths and weaknesses, Seagate and Western Digital HDD are highly comparable companies with significant scale, vertical integration and industry-leading technology. With the benefit of a pure-play, publicly traded HDD business in Seagate, we have a strong benchmark for the potential valuation of Western Digital's HDD business (in addition to the valuation history of Western Digital prior to the SanDisk acquisition).

See "Western Digital Vs. Seagate HDD Positioning" image.

Western Digital is currently valued at an enterprise value of $21 billion, representing a multiple of 1.1x LTM revenue and 3.4x LTM gross profit. This valuation compares to Seagate's $22 billion valuation and multiples of 1.8x LTM revenue and 6.1x LTM gross profit. Given the comparability of these businesses, Western Digital's HDD business can be valued at an enterprise value of approximately $17 billion, largely based on Seagate's revenue and gross profit multiples and using March 2022 LTM metrics. The implications are extraordinary for investors: Western Digital's HDD business would be worth more than 80% of the Company's entire current enterprise value, implying approximately $4 billion in value for Flash (or 0.4x Flash revenue). Even if we apply punitive discounts to the HDD business, we believe the market-implied valuation for Flash is highly compelling.

See "Current Multiples and Western Digital Current EV & Implied NAND EV" image.

Valuation of Flash

The Flash industry has grown tremendously over the last decade and is expected to continue growing at a 12% annual rate over the next several years. Interestingly, long-rumored consolidation has been slow to develop, as numerous scale players remain. These include Samsung, Kioxia (formerly Toshiba Memory), Western Digital, SK Hynix (including its ownership of Intel NAND), Micron and YMTC. None of the publicly traded companies are pure-play NAND businesses, which makes valuation comparisons between these companies difficult.

Instead, we can review the history of NAND M&A transaction multiples for valuation guidance. We can begin with Western Digital's own acquisition of SanDisk in 2016 for $17 billion in enterprise value, representing a multiple of 3.0x LTM revenue. In 2017, an investor group led by Bain Capital paid $18 billion for Toshiba Memory (now called Kioxia) at a valuation of 1.9x LTM revenue. In 2020, SK Hynix bought Intel's NAND business for $9 billion, representing 1.8x LTM revenue in total cash consideration.

We believe the valuation for Kioxia is most informative given its special relationship as the JV partner to Western Digital's Flash business. Together, Kioxia and Western Digital share extensive R&D development and manufacturing facilities in Japan and enjoy differentiated technology and scale advantages. Western Digital's interest in acquiring Kioxia is well documented over the years, including the $14 billion bid proposal in 2017 (1.8x LTM revenue) and the rumored $20 billion transaction value last year (1.7x LTM revenue). In the last five years, Kioxia has been publicly rumored to receive interest from a long list of other strategic and financial parties, including Micron, Broadcom, SK Hynix, Foxconn, Kingston, Softbank, KKR and Silver Lake.

See "NAND M&A Precedents, EV/LTM Revenue" image.

We also have the benefit of SanDisk's trading history as an independent public company prior to Western Digital's acquisition. Before the transaction announcement, SanDisk generated $1.2 billion of operating profit on $6 billion of revenue and was valued at an enterprise value of $12 billion. Since then, the NAND flash industry has continued to grow, and Western Digital's Flash business now generates $10 billion of revenue with strong gross margins. This scale, in conjunction with the differentiation of its two-decade partnership with Kioxia, would position the Flash business for success as a standalone company once again.

Based on our review of precedent transactions, the trading history and our perspectives on the NAND industry over the next several years, we believe Western Digital's Flash business can be worth $17 to $20 billion, or 1.5x to 1.75x 2023 revenue. We believe there could be meaningful upside to this valuation based on the long track record of synergy realization in analogous consolidation transactions within the HDD and DRAM industries.

Proposed Direct Investment in Flash

To demonstrate our own conviction in the value of a standalone and focused Flash business ("FlashCo"), Elliott is proposing to invest $1+ billion of equity capital into FlashCo at the same valuation range of $17 to $20 billion with proceeds to be used for continued growth and the next generation of manufacturing facilities. This capital could be utilized either in a spin-off transaction or as equity financing in a sale or merger with a strategic partner. We would welcome the opportunity to make this direct investment, as we believe the need for future NAND capacity is attractive and can generate strong returns. In addition, we believe there are likely other strategic and financial parties who would have an interest in participating in a transaction as well.

With Western Digital's decision to withdraw its dividend, the Company has de-levered to less than 1.4x credit-agreement EBITDA (and 0.9x on a net debt basis). This de-leveraging since the SanDisk acquisition provides flexibility for the potential capital structures of the HDD and Flash businesses. In conjunction with our proposed $1+ billion equity investment, we strongly believe that both businesses would have conservative capital structures to fund organic investment and the ability to initiate a new capital-return program for shareholders.

Unique Value Opportunity

We believe the value opportunity at Western Digital is uniquely compelling. While both business units experience cyclicality in demand and pricing, we believe they both can continue to grow with their markets and generate solid profitability and free cash flow over the next several years. In the analysis below, we illustrate the path to $100+ per share by the end of 2023, representing a total return of approximately 100% during the period. Our 2023 valuation assumes that HDD is worth $17.8 billion (1.9x CY23E revenue), that Flash is worth $18.1 billion (1.6x CY23E revenue) and that Western Digital generates more than $2 billion of free cash flow through the end of 2023 (after separation costs and the IRS settlement).

See "Western Digital CY23 EV Bridge, $bn and Western Digital CY23 Target Price Bridge, $ per share" image.

We rarely identify opportunities with such an attractive risk-return profile, especially in situations where a Board can take clear, value-maximizing action. This level of upside would far outweigh any potential costs incurred to facilitate the separation. In addition, any collaboration that occurs today between HDD and Flash can be maintained through a thoughtfully constructed commercial agreement to ensure both businesses can succeed independently without sacrificing initiatives that would benefit from ongoing partnership. These agreements are common in numerous examples of spin-offs and sale transactions involving a business unit.

Finally, Western Digital reminds us of similar companies where we have seen substantial strategic, financial and operational benefits from a separation. A highly relevant and recent example is the spin-off of Dell Technologies' interest in VMware. Elliott had a long-term investment in this situation dating back to EMC in 2014, when we advocated the separation of EMC's interest in VMware. After Dell acquired EMC in 2016, Dell integrated EMC into its core business and began a multi-year effort to leverage the scale and capabilities of Dell, EMC and VMware. Eventually, Dell determined the best path for both companies was a spin-off of its interest in VMware in 2021. Of particular relevance to Western Digital, Dell and VMware also entered into a commercial agreement to maintain their strategic relationship, co-engineer solutions and align on sales and marketing activities. The results were exceptional: Dell's stock has earned a 78% total return since the announcement of a spin-off exploration.

Working Together

In closing, we have great respect for Western Digital's history and the critical role it plays in the computing and storage industry. Few companies can claim five decades of success through tidal waves of technological change. This achievement was made possible through the effort and ingenuity of Western Digital's leadership and employees over multiple generations. Western Digital's people and products are industry leading; with the right strategic course correction, the Company will be well positioned for its next decade of success.

As a next step, we look forward to discussing our recommendations with you over the next several weeks. Our goal is to align with the Board on this path forward, and Elliott would welcome the opportunity to engage closely with the Company throughout this process. We appreciate your consideration and will make ourselves available at your convenience for further discussions.

Best regards,

Jesse Cohn

Managing Partner

Jason Genrich

Senior Portfolio Manager

About Elliott

Elliott Investment Management L.P. manages approximately $51.5 billion of assets. Its flagship fund, Elliott Associates, L.P., was founded in 1977, making it one of the oldest funds under continuous management. The Elliott funds' investors include pension plans, sovereign wealth funds, endowments, foundations, funds-of-funds, high net worth individuals and families, and employees of the firm.

1 Elliott's involvement in this market dates to our 2006 investment in Flash provider, Lexar, which was acquired by Micron. Over the course of our investment, we engaged with numerous industry players, including the leadership team of SanDisk at the time.